Decarbonising steel: hydrogen or metal oxide electrolysis?

The major steel companies in Europe now have advanced plans for switching away from coal to hydrogen. The first large scale plant is likely to open in 2026 in Boden, northern Sweden as the first site of H2 Green Steel. H2 Green Steel promises to manufacture 5 million tonnes a year of near zero carbon metal by 2030. Many other steel-makers have made ambitious promises, and have gathered substantial subsidies in most large European countries (not Britain) to make the transition.

The sense of an almost inevitable switch towards hydrogen was punctured last week by a new fund-raising for a company focused on an entirely different route to decarbonisation. Boston Metal took in $120m to develop steel-making using electrolysis. Investors included ArcelorMittal, the largest steel-maker outside China. ArcelorMittal is also backing hydrogen and has invested in carbon capture on its Belgium plant using Lanzatech technology.

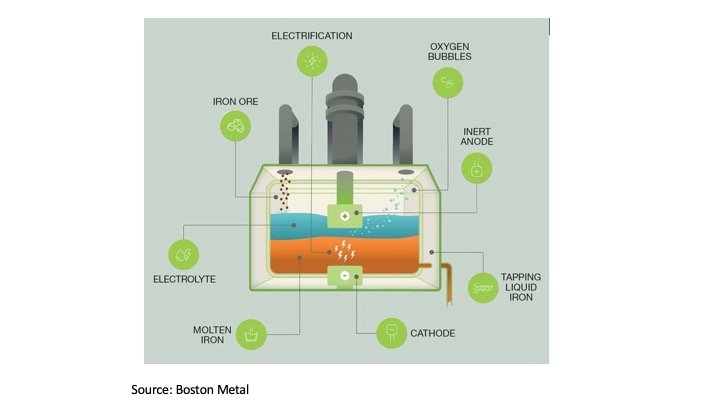

Boston Metal says that if iron ore can be heated to 1600 degrees using electricity in a liquid solution, it will separate into iron and oxygen. This is called Metal Oxide Electrolysis (MOE) and is similar to the standard process for making aluminium from bauxite, although at a substantially higher temperature. One of Boston Metal’s core innovations is a type of anode that can tolerate the temperatures inside the furnace.

Let’s look quickly at the advantages and disadvantages of the Boston Metal approach compared to the prospective hydrogen equivalent.

The advantages

1. Boston Metal takes iron ore and puts it through its electrolysis furnace and produces liquid steel. If the technology works as promised, this is remarkably simple compared to steel-making using coal, and seems very straightforward even compared to hydrogen. Direct Reduced Iron (DRI) using hydrogen takes iron ore, turns it into pellets, then puts it into a furnace to make iron. The iron is then made into steel in an electric arc furnace.

2. The technology is modular. Boston Metal’s basic product is the size of large bus and an indefinite number of modules can be placed next to each other. By contrast, a DRI plant will have to be large to gain maximum efficiency.

3. Financial details aren’t available but the capital costs may eventually be lower per unit of steel-making capacity than a hydrogen DRI plant, but only a very large scale.

4. Importantly, the process can use iron ore of any grade. DRI probably requires ore at the top end of the iron-containing spectrum in order to avoid having to put the molten metal through a basic oxygen furnace, a further step in the steel production process

The disadvantages

1. The technology requires a continuous and stable supply of electricity. It will need huge quantities with near 100% reliability, so many places in the world will be unsuitable. By contrast, the hydrogen for steel making can be made anywhere and then transported to the steel site. And unlike the Boston Metal route which needs electricity all the time, a DRI plant can use hydrogen that has been stored for months.

2. The total energy needed for DRI production is probably lower than for Boston Metal. These numbers aren’t reliable but I think DRI production using hydrogen needs about 3.2 MWh per tonne of steel whereas the MOE process is said to require about 4 MWh.[1] Details are in the Appendix below. The difference may not seem much but, assuming a price of $40 per MWh of electricity, the cost premium is about $32. In the context of steel prices of around $600 a tonne (highly variable), this difference is significant.[2] For comparison, conventional steel making uses about 5.2 MWh of energy in the form of coal per tonne.

3. A large DRI plant constructed today might make 5-10 million tonnes of steel a year. But at the moment the Boston Metal technology is at the scale of about 1 tonne a week from each module.[3] By 2026, the output is forecast to rise to about 1,200 tonnes a year and then eventually to more than one million tonnes. The scaling up of the MOE process so that capital costs are minimised may take decades and the DRI approach is more ready for very large scale operation. (DRI using syngas made from natural gas rather than pure hydrogen has been operating for several decades and now produces over 100 million tonnes of iron).

4. If I understand it correctly, the ‘Inflation Reduction Act’ in the US seems likely, at least in the short term, to give huge impetus to the manufacture of green hydrogen, offering a subsidy of up to $3 per kilogramme. Potentially, this brings the net cost down to cents per kilogramme within a few years. It isn’t clear to me that just using renewable electricity as in an MOE process would benefit from similar generosity. Please tell me if I am wrong.

Boston Metal’s success or failure has very wide significance for the hydrogen industry of decades to come. Steel-making is likely to be the single largest end-use for H2, absorbing up to 100 million tonnes out of total hydrogen production of about 500 million tonnes by 2050. But BP’s recent Energy Outlook forecasts about 50 million tonnes of H2 used in steel making so my predictions may be somewhat too aggressive.[4]

At current (January 2023) coking coal prices of about $190 a tonne, both hydrogen and MOE production routes will be probably become cheaper than the conventional blast furnace approach within a few years. (I’m assuming $40 a MWh for renewable electricity for use in either alternative process). Moreover, a carbon tax/border adjustment of $100/€100 a tonne will make coal-based steel entirely uneconomic against both hydrogen and MOE.

On balance, I think that hydrogen will still capture a large fraction of the world’s steel making by 2040. But I’ll be watching Boston Metal’s future steps with great interes

Appendix

The energy needs for making steel using hydrogen are approximately as follows.

Kilowatt hours per tonne

* Pelletizing the iron ore - 220 kWh

* Generating the hydrogen - 2500 kWh

* The electric arc furnace - 450 kWh

Total - 3,170 kWh per tonn

[1] Source: Boston Metal

[2] Source: Trading Economics

[3] https://www.thechemicalengineer.com/features/electrochemistry-for-greener-steel/

[4] https://www.bp.com/en/global/corporate/energy-economics/energy-outlook/hydrogen.html?sectionSlug=eo23-page8-section1