Chris Goodall

DRAFT, for comment

SUMMARY

Many times a year I am contacted by people who have had electric heat pumps installed at their house. Almost all complain that their utility bills have sharply risen and also that their home is no longer as warm as it was. Sometimes the reason is that the householder has not been properly trained on how to operate the heat pump but mostly the causes seem to be a mixture of poor installation and inappropriate choice of equipment.

Despite increasing evidence of underperformance and high costs, the UK continues to push to increase the rate of installation, targeting 600,000 new heat pumps a year by 2028. I use this note to identify six reasons why this surge may be a mistake and why it might be better to replace natural gas central heating with hydrogen boilers to achieve our decarbonisation objectives.

* Electricity in the UK is over five times more expensive than natural gas. Although heat pumps are about three times more efficient that gas boilers, this isn’t enough to compensate for the vastly higher price of electricity.

* Heat pumps are far more expensive to install than gas boilers, whether running on hydrogen or natural gas.

* Heat pumps often don’t work effectively. (This may be a consequence of poor installation or, more likely, the low insulation standards of typical UK houses).

* Heat pumps use a lot of electricity. As a result, the distribution network, currently responsible for 22% of domestic bills, will need very expensive upgrading to deal with the increased electricity demand.

* Hydrogen can be stored in large volume whereas electricity cannot be. This means that on cold days, when heat demand might be ten times today’s electricity requirements, hydrogen will be much better at dealing with peak demand

* Similarly, hydrogen will be more able to cope with high rates of increase in energy demand as the cold weather arrives.

These arguments are dealt with in detail below. My conclusion is that hydrogen needs to considered as the primary means of decarbonising domestic heat, the creator of about 20% of UK emissions.

I start by looking briefly at why heat pumps are generally thought to be better than hydrogen at servicing domestic needs before going on look at the weaknesses in the case for any form of electric heating compared to the use of hydrogen.

The arguments against hydrogen in heating.

1, Electricity can be decarbonised relatively easily. The current wisdom is that we should therefore shift as many energy-using activities to electricity as we can. This includes domestic heating, which is currently responsible for about 20% of UK emissions.

2, The most energy efficient way of delivering electric heating is through the use of heat pumps, say the proponents. Therefore we should try to expand the use of heat pumps as fast as possible. Why are heat pumps relatively efficient? A heat pump will normally deliver more heat into a building that it actually consumes in electricity. It is transferring heat from one place to another, not generating it. This is the crucial reason why researchers and policy-makers are emphasising the virtues of rapid expansion of heat pump installations.

The reasons why hydrogen will be a better alternative than heat pumps for at least a large fraction of UK heating.

I suggest that there are six reasons why hydrogen should nevertheless be extensively deployed for domestic heating in the UK. (These are not arguments that there should be no heat pump installations but rather that hydrogen will be better at serving the bulk of demand. New housing developments with well-insulated properties should certainly be furnished with ground source heat pumps, for example).

1. The relative price of gas and electricity

Proponents say that heat pumps save householders money. This is very unlikely to be true. The reason is the ratio between the price of gas and that of electricity in the UK.

In early April 2021 the prices offered to me by the largest UK utility, British Gas, were as follows[1]:

Electricity 17.753 pence per kilowatt hour

Gas 3.331 pence per kilowatt hour

In other words, electricity is well over five times as expensive as gas per unit of energy.[2] A quick look at tariffs from other suppliers confirm that the British Gas ratio is broadly representative. A customer switching to electricity from gas will therefore pay far more unless the new heating system is very much more efficient.[3]

Heat pumps are indeed more efficient. In the best installations, where a ground source pump is feeding a well-designed underfloor network in the home, it may be possible to get 4 units of heat for each unit of electricity supplied over the course of the year. But typically an air source heat pump feeding domestic radiators will only achieve about 2.7 units of heat with one unit of electric power.

Gas boilers aren’t 100% effective at turning gas into heat in the radiators. The rated efficiency of a new boiler can be as high as over 92%. However even the best modern units are sometimes badly installed or the home heating network is not ideally set up to achieve the best heating from the gas consumed. It might be better to assume a figure of 85% for a new boiler.

Let’s compare the costs of a home using 12,000 kilowatt hours of gas and a residence delivering the same amount of heat using a heat pump.

Gas – 12,000 kWh of gas costs £399.72 (plus the standing charge). This delivers 85% of 12,000 kWh as heat into the house, or 10,200 kWh.

Electricity – 10,200 KWh provided from heat pump at an efficiency ratio of 2.7 = 3,777 kWh of electricity consumed. This costs £670.68 at current prices, or £271 more than gas.

The conclusion is clear. Switching to electric heat pumps from gas central heating will cost most UK householders substantial amounts of cash, probably increasing typical bills by more than 50%.

Would the use of hydrogen be any better? It depends on the price of hydrogen of course. And we cannot forecast that accurately. (Even though people like me try to do this all the time).

Let’s use two different numbers. First, $1.50 per kilogramme of hydrogen. This price is often used as an estimate of what price hydrogen will achieve by the end of the decade. But this depends on the rate of fall of renewable electricity costs. These dominate the cost of making hydrogen.

At $1.50 a kilogramme, hydrogen costs 4.5 US cents per kilowatt hour. This is equivalent to 3.26 UK pence per kilowatt hour. Gas is currently priced at around 1.6 pence per kilowatt hour on the UK wholesale market. So hydrogen will be about 1.66 pence per kilowatt hour more expensive than gas at wholesale, or around double the cost.

We can estimate the price of hydrogen delivered to the home by adding this amount to the price of today’s gas, plus a small addition to reflect the slightly higher cost of shipping hydrogen through today’s natural gas pipelines.[4]

If we add a total of, say, 1.8 UK pence to today’s price of gas we arrive at 5.131 pence per kilowatt hour for a domestic user. A gas usage of 12,000 kilowatt hours will cost the householder £615.72. This is an annual increase of over £200 but is still cheaper than the heat pump alternative at £670.68.

The second number I want to use is the price that would equalise the cost of the energy typically used for a heat pump and that of hydrogen. This could either be achieved by lower electricity prices or higher hydrogen prices. Very roughly, we achieve equality of heat pump and hydrogen prices either by raising the hydrogen price to about $1.72 per kilogramme, up from the target of $1.50, or cutting the price of electricity to about 16.2 pence per kilowatt hour, down about 9% from today’s rates.

A hydrogen price of $1.72 per kilogramme is possible in low-cost locations by 2030. These places may include the UK as the price of offshore wind and solar continue to decline. A recent report from Bloomberg New Energy Finance said[5]

Our analysis suggests that a delivered cost of green hydrogen of around $2/kg ($15/MMBtu) in 2030 and $1/kg ($7.4/MMBtu) in 2050 in China, India and Western Europe is achievable. Costs could be 20-25% lower in countries with the best renewable and hydrogen storage resources, such as the U.S., Brazil, Australia, Scandinavia and the Middle East.

The key conclusion is this. A push into heat pumps will significantly raise the heating costs of UK homes. (Partly, of course, this is because they are so badly insulated by European standards). At possible 2030 hydrogen prices, it may be cheaper to switch to hydrogen for most homes, unless government reduces the costs imposed on electricity suppliers.

2. The cost of installing heat pumps versus replacement hydrogen central heating boilers

Heat pumps are expensive to buy and to install. It depends on the size and complexity of the installation but a figure of £4-5,000 for a typical UK house (semi-detached, 160 square metres) is probably reasonable for an air-to-water unit. If the radiators in a house need replacement, which is likely in many installations, the cost will be even higher, possibly doubling the eventual bill.

We cannot yet know the cost of a hydrogen boiler for the home. But Worcester Bosch, the largest provider of gas boilers in the UK, says that it expects them to cost about the same as today’s models. It has units on trial. So the average house should see a cost of around £2-2,500, including installation. This is half the cost of a heat pump. Very, very roughly, the annual depreciation of a heat pump is likely to be at least £100 more than a hydrogen boiler. So even if cheap finance is available, the heat pump is going to add substantially to the full costs of heating a home.

3. The reliability and performance of heat pumps versus standard boilers

The UK heat pump installation industry is still small and installation standards have yet to reach uniformly high levels. Many owners are unhappy with the performance of their heat pumps, saying that they feel that the units do not deliver reliable heat. Partly this may be as a result of householders trying to restrict the use of the pumps because of the high bills that are being received for increased electricity use. But it is undoubtedly true that many homeowners with heat pumps are not able to heat their house consistently to a comfortable level. Bills are also far higher than expected across the country.

4. The extra infrastructure required across the country

The demand for heat for houses varies hugely throughout the year. At peak, domestic heating probably requires about 170 gigawatts during half hour periods on very cold days.[6] This can be compared to levels peaking at around 50 gigawatts for today’s electricity consumption at similar times.

If the average heat pump delivers 2.7 units of heat for each 1 unit of electricity consumed, the figure of 170 gigawatts is lowered to around 60-65 gigawatts if all housing is converted. This is equivalent to adding 120% to total electricity demand. Actually, the numbers will be far worse than this because air source heat pumps work less efficiently at lower outside temperatures when heating needs are greatest. The actual increment to UK electricity demand is likely to be more than 100 gigawatts from a full conversion, tripling maximum electricity demand.

Two problems result from this. First, it will require large amounts of new network infrastructure, ranging from transmission lines to local transformers. I cannot estimate the cost but it will almost certainly add very substantially to electricity bills, further raising the running cost of heat pumps.[7] In addition, many of the required upgrades will be intensely politically controversial. Large-scale transmission lines are already extremely difficult to impose on communities, as both the UK and other countries such as Germany have found.

The second problem is the availability of renewable electricity supply to meet the increased peak demand levels. To provide reliable power at 150 gigawatts in deep winter, when wind speeds are likely to be low because of the anticyclonic conditions, is an almost impossible challenge.

The four reasons for deep reservations about the viability of air source heat pumps above are complemented by two reasons why hydrogen will be a more appropriate choice for much domestic heating.

5, Hydrogen can be stored cheaply and shipped around without major investment in new infrastructure.

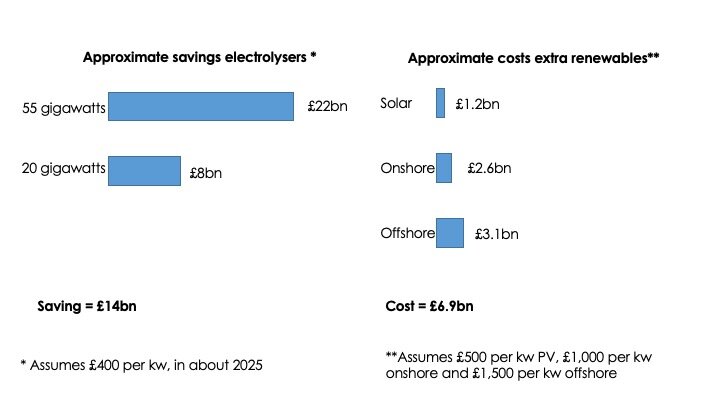

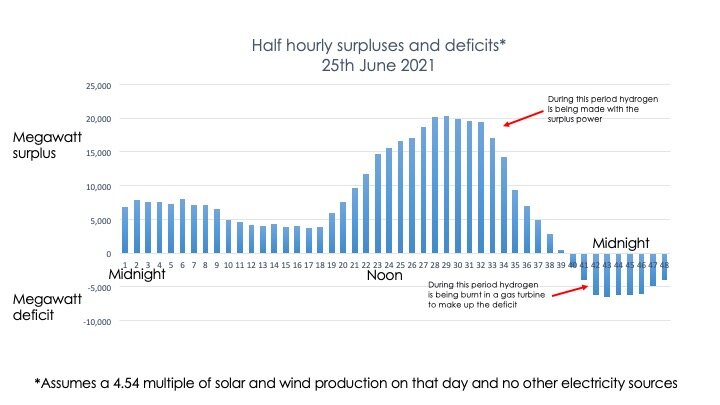

Within a few years, the UK will frequently have too much electricity as offshore wind booms. The government has a target of 40 gigawatts offshore by 2030, up from just over 10 gigawatts today. This will meet total demand on its own over long periods even before considering onshore wind and solar PV. Solar PV is also likely to double by 2030, based on current indications of future build-out.

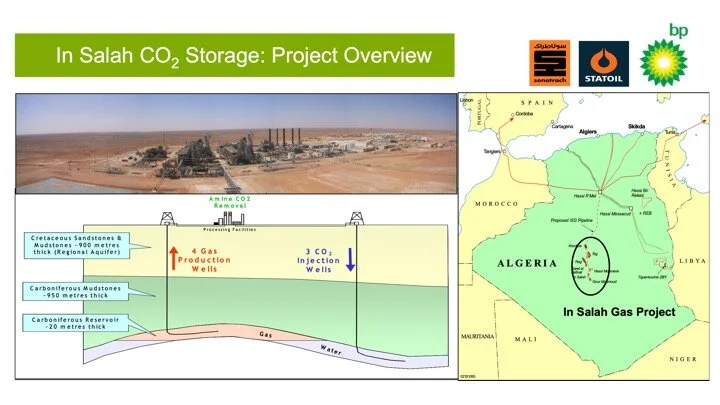

When renewables supply exceeds demand, hydrogen is the only viable long-term storage medium. The UK is well supplied with potential salt caverns in which hundreds of terawatt hours can be stored. The hydrogen can then be used for domestic heating at some future point, as well as for other applications such as ammonia manufacture, steel-making, chemicals manufacture and for use in electricity generation at times when renewables supply is limited.[8]

Hydrogen can use existing pipelines and domestic supply networks. They can be switched relatively easily from the distribution of natural gas and the UK gas operators are heavily engaged in planning for this. (As are most European networks) More compressors will be required on the distribution lines but the cost of this is likely to be insignificant compared to the extra electricity distribution costs required by a large scale switch to heat pumps.

6, Hydrogen is far better than electricity at dealing with sharp peaks in demand

It is not simply that hydrogen is easy to store and transport. It is also that it is better able to cope with rapid changes in the level of demand. The ‘ramp rate’ is the amount of change in energy use as demand rises, for example when householders return from work. At the moment, the electricity ramp rate peaks at less than 5 gigawatts an hour. But the ramp rate for heating is probably more than 10 times this level.[9]

This number would fall if heat pumps were providing 100% of domestic heat because they should be operated constantly, even when householders are out of the house. But, nevertheless, a full transition to heat pumps will significantly increase the variability of electricity demand, posing problems for suppliers and distribution network operators. Gases, including hydrogen, are far better at handling this variability, partly because the gas in the pipelines themselves represent substantial stores of energy which can meet sharp changes in demand.

To summarise: domestic heating uses more energy (about 300 terawatt hours a year in natural gas alone) as all electricity requirements combined. And usage is highly variable, peaking on cold days at almost six times electric power employed for all purposes. Running an energy system to service such a large and unstable demand using electricity is unlikely to work. It is far better to employ a more easily storable energy vector such as hydrogen, which can be easily made and stored at times of excess power generation and then distributed when needed.

Hydrogen is currently substantially more expensive than natural gas. But the gap between the two commodities is highly likely to narrow sharply in the next decade and may then disappear in energy-rich countries such as the UK. The current focus on heat pumps as the principal route for decarbonisation of heating therefore makes little sense.

April 8th 2021

Chris Goodall

chris@carboncommentary.com

+44 7767 386696

[1] Direct Online Only tariff Version 7 for a house in Oxford.

[2] Part of the reason for this large difference is that the costs of decarbonisation have been largely loaded onto electricity rather than gas.

[3] It is helpful to note that the ratio between gas and electricity prices is particularly wide in the UK. EU Commission data suggests that the average ratio in the EU is about 3.3, not the 5.3 recorded in the current British Gas tariff. Seehttps://ec.europa.eu/eurostat/statistics-explained/index.php/Electricity_price_statistics and https://ec.europa.eu/eurostat/statistics-explained/index.php/Natural_gas_price_statistics

[4] Hydrogen is less dense and although it can probably be transported at higher pressure than natural gas it still requires more compressor stations to ship through the network.

[5] https://assets.bbhub.io/professional/sites/24/BNEF-Hydrogen-Economy-Outlook-Key-Messages-30-Mar-2020.pdf

[6] https://www.sciencedirect.com/science/article/pii/S0301421518307249

[7] Currently distribution charges make up 22% of the average domestic electricity bill. It doesn’t seem unreasonable to suggest that this number could double if the UK had to install the infrastructure to handle peak electricity flows of 3 times current levels.

[8] Hydrogen power stations, such as adapted gas turbines, are now being planned in Europe and elsewhere.

[9] https://www.sciencedirect.com/science/article/pii/S0301421518307249