Fuels from air and water

A future free of fossil fuels requires us to economically produce oil and gas substitutes from synthetic sources. This is because will continue to need oil and gas for activities that are difficult to electrify, such as aviation. As importantly, synthetic oil and gas can provide our electricity when sun and wind are in short supply without adding to the CO2 in the atmosphere. They will provide the main storage medium for high latitude countries, taking surplus electricity and holding the energy in the form of liquids for use on still winter nights.

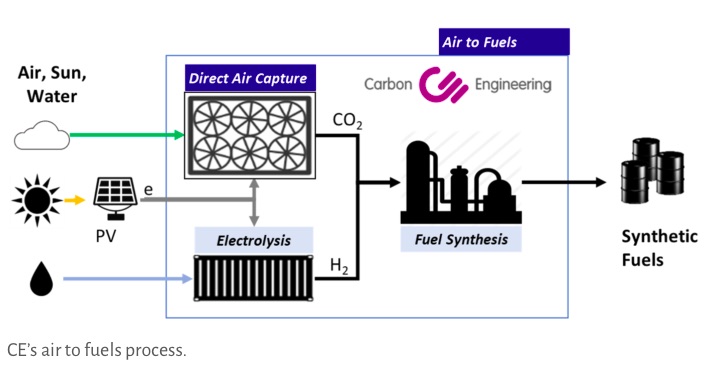

Synthetic fuels will generally be made using renewable hydrogen combined with carbon-containing molecules not derived from fossil sources. Canadian business Carbon Engineering has just announced that it has made small quantities of fuel entirely from renewable sources using CO2 taken directly from the air.

I think this advance probably qualifies as the most important low-carbon innovation of 2017.

If the cost of this process can be driven down to levels comparable with $60/barrel oil, we have a realistic prospect of all world energy needs being served by renewables, either used directly for power, or employed to create zero-fossil fuels to complement intermittent sources of electricity.

Carbon Engineering (CE) generates its hydrogen from electrolysis. When electricity is abundant, electrolysis is used to split water into H2 and oxygen. Heat is a by-product. The hydrogen is then merged with the CO2 captured from the atmosphere to form useful fuels similar to petrol.

There is no magic in this process. Electrolysis is simple, and increasingly efficient and cheap. Direct removal of CO2 from the air is usually thought of as expensive in energy terms but has been practiced, for example, on submarines for many decades. Reacting hydrogen with carbon dioxide, or its derivatives such as carbon monoxide, is uncomplicated and can be carried out using either chemical or biological routes to create liquid fuels. It is done in chemical plants around the world today. CE’s achievement is to do all these things in one place simultaneously. In effect it has shown a potentially viable route to decarbonisation of energy, not just electricity.

Why? The thesis of my book The Switch is that solar photovoltaics will become increasingly cheap. As a result, developers are prepared to offer electricity from PV at lower and lower prices. Auctions that result in costs of around 2-2.5 US cents per kilowatt hour are now common in the sunniest countries. It is not difficult to find forecasters writing that solar costs will decline to less than one cent per kWh within a decade or so.

The fall in the price of solar-derived power will have a much wider effect than simply on electricity prices. Put at its simplest, it means that solar PV becomes a far cheaper source of energy than fossil fuels. At a price of $60, the underlying energy in a barrel of oil costs around 4.4 US cents per kWh.[1] (For comparison, gas in the UK currently costs around 2.6 US cents per kWh at the wholesale level).

The implication of this disparity is clear. If we can use solar electricity to make petrol equivalents, we may be able to undercut oil, and ultimately replace fossil fuels entirely. Electrolysis to make hydrogen is about 80% efficient today using the newest technologies. This means that solar electricity costing 2 US cents per kWh is used to make hydrogen, the cost of this energy-carrying gas is about 2.5 cents per kWh, well below the cost of oil.

But CE very definitely doesn’t say that its synthetic fuels are competitive today with oil once the cost of carbon capture is included. Grabbing CO2 from the air is thermodynamically inefficient process and uses over 2,000 kilowatt hours per tonne captured, mostly in the form of low-grade heat at around 100 degrees. CE indicates that it has a target cost of around $1.00 a litre for its fuels. That’s probably about double the US wholesale price of petrol and the oil majors won’t be quaking as a result of this week’s announcement.

But two things should make them nervous. First, as renewables grow in the share of electricity markets around the world, they will push down the costs of electricity. As I have said before, the impact of very high winds on north European electricity markets is to force short-term prices down to zero or below. This means that the cost of hydrogen falls as well, as does the price of CO2 capture. (Energy dominates the cost of direct air capture of CO2). This brings down the price of synthetic fuels because they will be principally made at times when energy is cheap even if this means that the ‘refinery’ only works half the time.

In previous work I have seen, CE’s cost assumptions include energy prices that are broadly comparable to average wholesale costs of today. I think this is unduly conservative. Many of the hours over the course of a year will see surpluses of electricity and very low prices, this driving down the final cost of synthetic fuels, probably well below oil.

The second effect is more uncertain but I think is still powerful. As electric cars grow in number oil demand will eventually fall (my best guess is about 2025 for this crucial moment). A switch away from fossil sources towards synthetic oils will increase the speed of the decline from that point. Refinery utilisations will start to fall and upgrades will get increasingly difficult to justify. Staffing costs will tend to rise per unit of output. Existing assets including pipeline networks will get used less. In other words, the underlying economics of today’s oil producers and their refining and distribution operations will tend to deteriorate. Capital will become more difficult to attract into the industry.

This will be a slow process. The oil industry will not collapse overnight. But advances like this week’s CE announcement will eventually reduce the economic viability of the oil industry, speeding up the move from fossil fuels.

What will eventually happen will probably look like the current crisis (I think this is a fair use of the word) in the gas turbine industry. Until six months ago, the titans in the industry (GE, Siemens and Mitsubishi) assumed that the rise in renewables would be good for gas, because CCGT generation would still be needed to supplement intermittent sources of power. It hasn’t turned out that way – after falling in numbers for years, just 100 large turbines were ordered in the last year compared to 400 a few years ago. What is probably as important is that the existing gas plants around the world have been tending to work fewer hours a day. Maintenance needs, say both GE and Siemens, have fallen, reducing servicing revenues. This was completely unexpected. Last week GE said it would fire 13,000 people in the turbine division. A month or so ago, Siemens finally cut 7,000 jobs. The impact of GE’s failure to address the problems in its gas turbine business has been felt in a sharp fall in the company’s share price. This was a carbon bubble deflating very unpleasantly indeed. The same will eventually happen to fossil oil.

But the principal point I wanted to make here is that technologies like CE’s offer the prospect of being able to run the entire energy system, not just electricity, on renewables. It allows the world to invest hugely in wind and solar, with resulting over-supply for much of the days, months and years. Rather than being wasted, this excess will be used to make energy for aviation and other uses that are difficult or impossible to electrify and allow us to cope with periods of no sun or wind.

[1] $60 divided by 159 litres (a barrel) and by 8.8 kWh per litre.