Launch of UK solar forecasting service

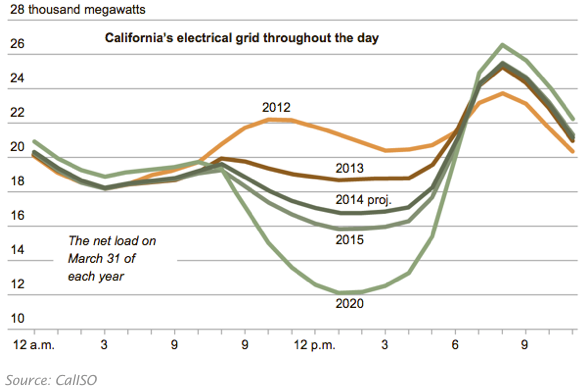

The March rush to complete solar farms combined with the advent of good weather gave us an unnoticed special event on Saturday. Was this the first time ever that electricity demand from the National Grid was lower in the middle of the day than it was at midnight? I think it might have been.

We saw the unsurprising consequence: negative prices for several hours in the market to balance electricity supply and demand. This highly unusual event may be a reason why your organisation should consider subscribing to a new service from Carbon Commentary which provides a PV output forecast for the whole of the UK for the next five days, updated hourly. Knowing how much PV electricity is going to flood the system will help make demand and price projections more accurate.

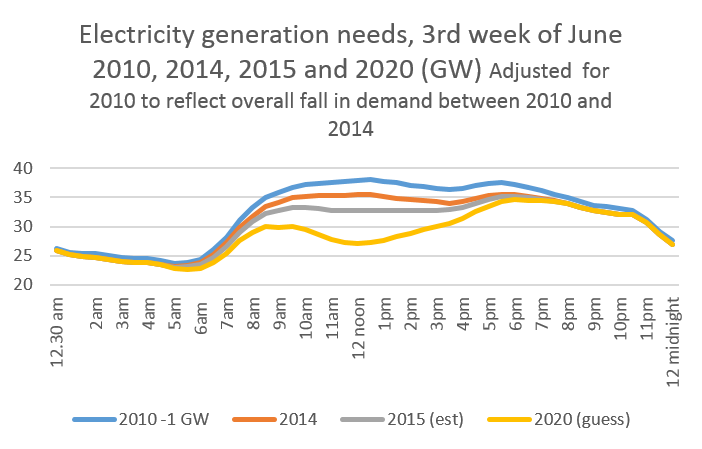

On the sunny Saturday afternoon UK electricity production fell to just over 25 GW. In the chart above, I’ve also shown the curve for the same day (this time a Sunday) in 2010, just five years ago. 2015 was a full 8 GW lower, or nearly 25% below the earlier level in the early afternoon

Part of this reduction comes from the general fall in electricity use. In the hours of darkness, this is running at about 3 GW, or the output of four or five gas fired power stations. The gap widens sharply as the sun arrives, with the reduction peaking just after lunchtime. The reason for the additional reduction is quite simply solar PV, which isn’t directly measured but deducts from the demand made on the national grid. With the exception of a few eccentric homeowners, there wasn't any PV in April 2010.

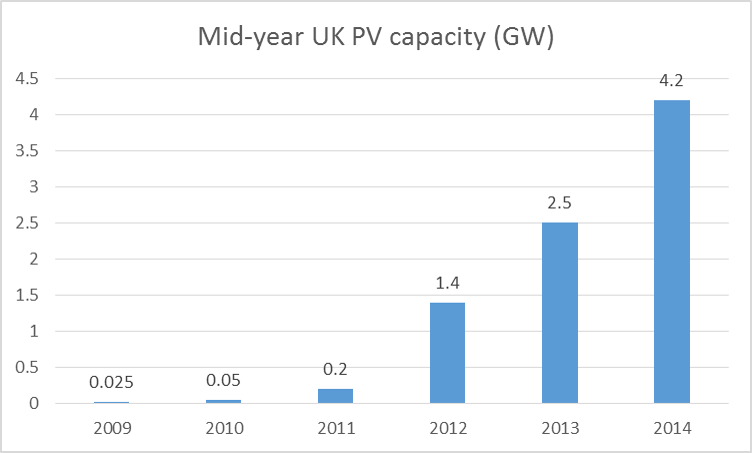

The end of March this year saw a successful scramble to connect many large PV farms around the country. And it really was ‘around the country’. These power plants are now as far north as Anglesey and not just in Cornwall. This splurge was responsible for adding at least a quarter to the UK’s PV generating capacity

The numbers are still a little soft but we think about 6.5 GW of PV is now operating in the UK. Many of the panels are on houses and school roofs but most are on open ground. As more data comes in, this figure may rise to nearer 7 GW.

On a clear day at around 1.30pm in mid-April, this PV base will produce just less than 5 GW. It won’t be as high as 6.5 GW because of electrical losses and because the sun isn’t quite high enough to give maximum power yet. This 5 GW estimate almost exactly matches the actual reduction we saw on Saturday and gives us the confidence to launch a new service.

Carbon Commentary now has a model which estimates how much solar electricity will be produced for each of the next 120 hours, or a full five days. It works by taking sunshine forecasts from Europe’s leading meteorological agency for each hour across 98 postcode districts in the UK and combining this with a detailed database of where all the UK’s solar roofs and huge farms are. (Thanks in particular to Simon Mallett of www.renewables-map.co.uk for dividing the 550,000+ smaller installations into postcodes).

We can feed this to subscribers each hour, or any other interval you choose. And we can break the figures into postcode areas if this is useful. It will be supplied as an Excel sheet and simple charts and will also be available on a separate web site.

The screenshot below from the electricity market portal shows why you might want to purchase a subscription to this feed.

The industry didn’t predict the surplus of PV gushing onto the network on Saturday. As a result, system prices fell to substantially less than zero in early afternoon. For more than two hours, users would have been paid large sums to take electricity. If you had known that the UK was going to produce 5 GW of solar electricity, rather more than the figure predicted by the other forecaster currently available, that inversion wouldn’t have been such a surprise.

Please contact me, Chris Goodall, at chris@carboncommentary.com or +44 7767 386696 if you’d like a one month trial subscription of the beta version of our new 5 day forecast. ,