Has the transition to low-carbon electricity caused bills to rise? And what will happen over the next few years?

The analyst Ben James provides very useful data on the composition of energy costs at www.electricitybills.uk. He calculates how a bill is made up for a household consuming 3,100 kWh a year, showing how much arises from the wholesale cost of electricity and how much from other elements, such as supplier costs, transmission and from the impact of government initiatives.[1]

We are locked in debate as to why electricity prices are so high and rising in the UK. We can use Ben James’ data from the last few years to indicate what percentage of the increase in electricity prices has been due to the growth in power prices and what share comes from other parts of the consumer’s bill. He also provides some careful forecasts of how the constituent elements will change over the years to 2030/31.

What do the numbers show for the past few years?

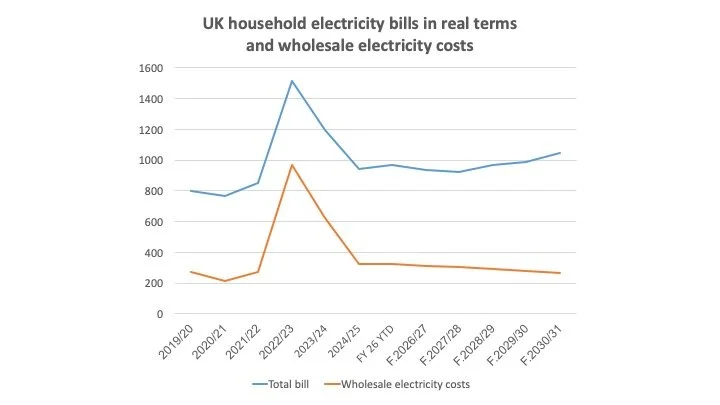

· For the period between 2019/20 and this year, the numbers from electricitybills.uk suggest that only about a third of the rise in electricity prices has occurred because of higher wholesale costs of electricity.

· Approximately another third arises directly or indirectly from the policies intended to support moves towards the full decarbonisation of the electricity grid.

· The final third of the increase comes from greater supplier costs and other smaller elements. In other words, it’s finely balanced as to whether gas costs or energy policies have caused more of the inflation we have seen.[2]

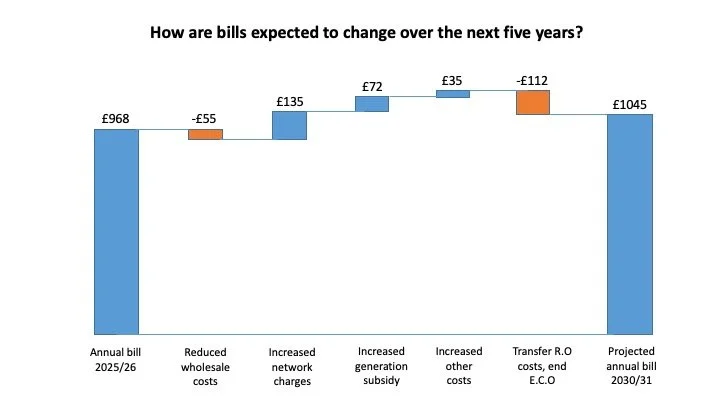

Looking ahead at the next five years, Ben James’ forecast estimates that household power bills will rise by 8% or more, even if the government continues with the recently announced temporary policy of removing the Renewables Obligation from the makeup of costs paid by buyers. (His views are not unusual; the business supply team at npower have similarly pessimistic forecasts for the period to 2030/31.)

· Within the total bills, he suggests we’ll actually see falling wholesale costs, a conclusion he comes to after a series of interviews with other industry analysts.

· The large bulk of the future rise in retail power prices is driven by the costs associated with the energy transition, such as transmission and distribution network improvements, the payments under the Contracts for Difference scheme, the rising costs of having to restrict electricity generation at times when the grid is overloaded and the subsidy costs for the proposed new nuclear power station at Sizewell.

These results make uncomfortable reading for those of us seeking the fastest possible transition to a wholly decarbonised electricity grid. The increase in high voltage transmission costs alone will wipe out the gains from decreased wholesale prices in the period from now until 2030/31. We should accept that we are now entering the period of maximum upward impact of government policies on retail electricity bills.

Let’s put this another way.

· In 2019/20, Ben James suggests that the real terms household electricity bill was £763 a year (NB: excluding VAT). By 2030/31, he suggests that the figure will be around £995, or 30% more.

· However, in that period the cost of the wholesale electricity bought to meet the demand from that household will see a small reduction from £272 (36% of the final bill) to £269, when it will be just a 27% share. Whatever else is tending to increase prices, it certainly isn’t the underlying cost of the electricity itself.

This unfortunate effect is almost certainly temporary; as improved high voltage transmission links are successfully completed, the costs of grid curtailment will fall sharply in the 2030s. Similarly, Renewable Obligation and CfD costs will decline as the subsidy periods end. In ten years time electricity bills will probably be substantially reduced as cheaper and cheaper renewables provide almost all the power into the UK grid and gas generation ceases to play an important role.

However the next few years will almost certainly see understandable discontent over high electricity costs. Whether we like to admit this or not, government policies towards electricity are imposing substantially higher costs on householders today.

The details - 2019/20 to 2025/26

Ben James provides estimates in both nominal and real terms. He also adds VAT to the final bill rather than to individual elements. My analysis of his numbers uses the costs expressed in 2025/26 real terms and without VAT.

His figures suggest a total electricity bill of £763 for a 3,100 kWh household in 2019/20 and an annualised cost of £922 in this financial year thus far. (The numbers for this year therefore exclude any changes in cost from January to March). This represents a supplement of £159, a real increase of around 21% over the nearly six year period.

In 2019/20, the cost of purchasing the electricity to supply to the household was £272 out of a total final bill of £763, a 36% share. (All figure in real terms). By 2025/6, this share had fallen slightly to 35%. The share of network costs and generation subsidies had also declined marginally to a total of around 43% of the bill in 2025/26.

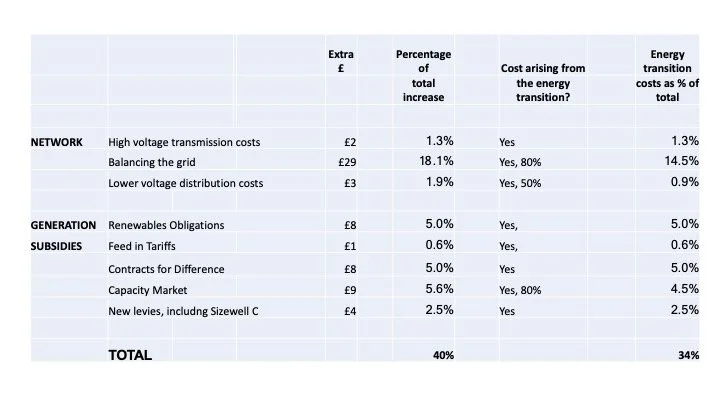

The constituents of the overall increment of £159 in bills, expressed in £ and as a percentage of the aggregate increase, are as follows:

Table 1: The sources of increased electricity bills in the UK

Source: www.electricitybills.co.uk. All data in real 2025 prices and exclude VAT. Figures are for a household consuming 3,100 kWh a year.

(Numbers are rounded and therefore do not exactly agree).

I have then estimated how much of the total increase is due to policies associated with the energy transition. These percentages are necessarily approximate. In the case of investments in the lower voltage distribution networks, for example, some extra capital expenditure would have been necessary to improve ageing infrastructure. But for the grid balancing costs, the substantial increase in costs arise almost entirely from the need to cope with the rising percentage of intermittent electricity supply. This has meant a steep but irregular increase in ‘constraint payments’ that are made to power producers obliged to disconnect from the grid. This was the single most important reason why bills rose as a result of energy policies.

In total, these rough estimates suggest that policies to speed up the move to low carbon generation were responsible for about 34% of the increase in bills from 2019/20 to this year. For comparison, 33% of the increment arose from higher wholesale bills, largely caused by increases in the price of gas supplied to power stations. The next most important reason for rising costs was the 13% increase in revenues retained by suppliers, partly to cope with higher bad debt levels.

In one sentence, electricity inflation is one third due to higher gas prices, one third to the cost of decarbonisation and one third for other reasons.

Table 2 How much of the increase in electricity prices has arisen from net zero policies?

Source: www.electricitybills.co.uk. All data in real 2025 prices and exclude VAT. Figures are for a household consuming 3,100 kWh a year.

The details - 2025/26 to 2030/31

The British government made two significant changes in a recent budget. It took 75% of the payments for the Renewables Obligation out of customer bills and placed the cost in general taxation until 2029. (Understandably, Ben James assumes this arrangement will actually continue indefinitely beyond 2029 because of the difficulty of raising household bills, particularly in an election year). It also abandoned the ECO scheme, which had used cash from electricity purchases to pay for improvements in the insulation of domestic homes. These two adjustments will reduce electricity bills by about £105 in the 2026/27 year according to the Ben James calculations.[3]

However these two changes are not sufficient to stop bills rising, even as expectations of future wholesale costs show substantial declines. After the reallocation of most of the Renewables Obligation costs, the real terms price of electricity for 3,100 kWh of household consumption is still projected to increase from £922 to £995 by 2030/31, a rise of £73 or 8%. And this number may be an underestimate; Ben James’ spreadsheets do not yet include figures for hydrogen or long duration storage subsidies because of the lack of information on likely costs.

In other words, the government’s commitment to reduce energy bills by 2030 by £300 for the typical household will not be met by projected retail electricity price changes.

Why are electricity bills expected to rise? In contrast with recent years, the cause is not an increase in wholesale costs, which are expected to fall from £324 to £269, a reduction of £55, or about 20%. The dominant causes of future retail electricity price inflation are network costs - up by £135 - and low carbon subsidies, now expected to increase by £72 a home if we exclude the cut to the Renewables Obligation.[4] (To restate the obvious point: if the government in its November 2025 budget had not removed 75% of Renewable Obligations costs from household bills, the expected increase would have been substantially larger.

The increase in network costs dominates the chart below. High voltage transmission charges double to around £105 from 2025/26 to 2030/31. Network balancing costs more than double and lower voltage distribution bills rise by over 25%.

Contracts for Difference, the active subsidy scheme for renewables, will cost the typical 3,100 kWh household £70 in 2030/31, up from £33 this year. The bills for the capacity market are projected to rise by £17 to £46. However these increases are more than balanced by the removal of 75% of the cost of the Renewables Obligation which saves the billpayer £85.

In summary, the expected annual change in real terms costs for a 3,100 kWh household bill is shown in the following chart.

Table 3

Source: www.electricitybills.co.uk. All data in real 2025 prices and exclude VAT. Figures are for a household consuming 3,100 kWh a year.

The likely rise in household bills is disturbing in itself. The further problem is that increased electricity prices are likely to cause a continuing flight of businesses from the UK, chased away by the costs of carrying out industrial activities here. We need to address this important public policy issue urgently. The net zero cause is not assisted by ignoring the impact of rising electricity bills, either on popular support or on UK industrial production.

[1] Ben James’ calculations use an electricity consumption of 3,100 kWh per year. Ofgem’s current estimate of the purchases of a typical household not using their electricity for heating is 2,700 kWh. Consumption continues to fall, even as more EVs are in use, because of more efficient household appliances and lights. And probably the impact of higher prices.

[2] The counter argument is that the increase in subsidy costs is a result of bringing more renewables onto the UK grid. The greater volumes of electricity from wind and solar have tended to reduce the requirements for the more expensive gas-fired power stations to operate. In this way, renewables subsidies could have reduced average power prices below would they might have been. The response is to say that without the policy-induced growth of renewables the UK might have seen the power market incentivise the construction of increased numbers of efficient CCGT stations, thus holding down power prices.

[3] The saving from the government’s Renewable Obligation reduction will fall from 2027/28 onwards as projects within the scheme gradually reach the end of their subsidy period.

[4] The payments made by households towards the construction of Sizewell C are not strictly subsidies but rather interest payments on investments being made to build the nuclear power station.