Heat

Submission to the UK Select Committee on Energy and Climate Change

(This is a submission to the Energy and Climate Change Committee of the UK Parliament, which is currently asssessing the country's policies on the provision of heat.

Summary

- In this note I want to advance the idea that the UK is gravely mistaken in trying to substitute electricity for gas for the purpose of home heating. Heat demand is much more seasonal than electricity need. Switching to heat provided by electricity will disproportionately increase peak demand for electricity, obliging the UK to waste large sums on capacity payments for electricity generating plant that will work for a few hours or days a year. The comfortable wisdom that providing heat using electricity is good for the UK is utterly wrong.

- In fact, we should stick with gas as the principal source of domestic heat. The infrastructure is there already and gas storage is simple and cheap. Crucially, we need to ensure that this gas is made from electricity at times when the grid is in surplus. This technology is called ‘power to gas’ and is a topic of central interest in other European countries. The UK has yet to wake up to the potential of this idea and the Committee could have a crucial role in bringing it to the attention of UK policymakers.

The size and seasonality of heat demand for homes.

1) The domestic heat need for the UK is approximately 400 terawatt hours (26 million households multiplied by about 16,000 kWh per home). This is over 4 times the need for electricity in the home.

2) The requirements for energy for domestic heat are far more seasonal than the need for electricity. In December, a cold day can see an average 24 hour residential heat demand of as much as 250 GW, almost ten times the need for electricity in the home and four times the maximum need for electricity across all sectors. In mid-winter, domestic demand for gas dominates industrial and commercial use. By comparison, on a warm summer’s day, heat demand in homes is restricted to ten or twenty gigawatts of hot water heating.

3) Within the winter day, the demand for residential heat peaks in the morning and in the early evening. This is approximately the same as for electricity, adding to the problem of peaking.

4) The need for residential heat may reach 500 GW over short periods, about twenty times the maximum need for domestic electricity. This single comparison should alert us to the danger to using electricity to substitute for gas heating.

5) The sharp peaks in winter heat need can be accommodated by the current mix of gas boilers combined with much smaller amounts of oil, LPG and of electric heating (much of which is taken from the grid at off-peak times when demand is relatively low).

6) Any part of the UK’s energy policy that does not recognise the extreme seasonality in heating need will fail.

Why is this important?

7) The government has plans for the decarbonisation of energy use. Its proposals for domestic heat are, in summary:

a. Increase biomass use

b. Large numbers of solar thermal collectors on homes

c. Hugely expand the number of homes with heat pumps, replacing domestic boilers

8) Biomass, solar thermal and some types of heat pump are strongly encouraged by the RHI (Renewable Heat Incentive). The government talks of installing many millions of biomass boilers, solar thermal collectors and heat pumps by 2020.

9) In addition, the government hopes that the Green Deal and Energy Company Obligation will decrease the demand for heat by improving residential insulation. But the evidence is that even aggressive insulation efforts will not cut the heat demand of the average home by more than about 40 percent. Achieving greater savings, householders find, can be extraordinarily expensive. This reality is too often brushed aside. Insulation is, at best, only a very partial solution to the problem of the cost and carbon emissions from heating.

10) Policy a). Increase biomass use. The total supply of wood and wood products such as sawmill waste in the UK is about 17 million tonnes per year. (Source: Tony Weighell for DEFRA at http://jncc.defra.gov.uk/pdf/Biomass.pdf). The average energy value of timber products is about 4,500 kWh per tonne. The average home uses about 16,000 kWh for space and water heating annually. Therefore a home heated by wood requires about 4 tonnes a year. If ALL the UK’s wood production was used for domestic heating, biomass might be able to supply about 4 million homes, or around 15% of the UK properties. Clearly imports might add to the availability of wood, but biomass can never realistically cover more than a small fraction of the UK’s heat need. Perhaps 80% of UK homes would, in any event, find it difficult to accommodate a pellet or wood chip biomass boiler.

11) Policy b). Solar thermal collectors. The total heat collected by an array on a house is unlikely to exceed 2,000 kWh a year. Installed on every house in the country, the total contribution to domestic heat need would be less than 10%, after excluding flats and other properties with no access to a roof. And, most importantly, solar hot water systems do not provide a significant contribution to heat requirements during the winter. Therefore they do not assist with the problem of the variability of heat demand.

12) Policy c).This leaves heat pumps as the main government instrument for decarbonising heat. The government now includes domestic air-to-water heat pumps under the RHPP (Renewable Heat Premium Payment) and RHI. (The comments in the following paragraphs apply mostly to this type of pump, not the ground source variety). Serious concerns have been expressed about the effectiveness of air source heat pumps by many users and energy commentators. They are often badly installed, the controls are too complex to be used by ordinary householders and don’t heat the radiators properly, leaving the house cold.

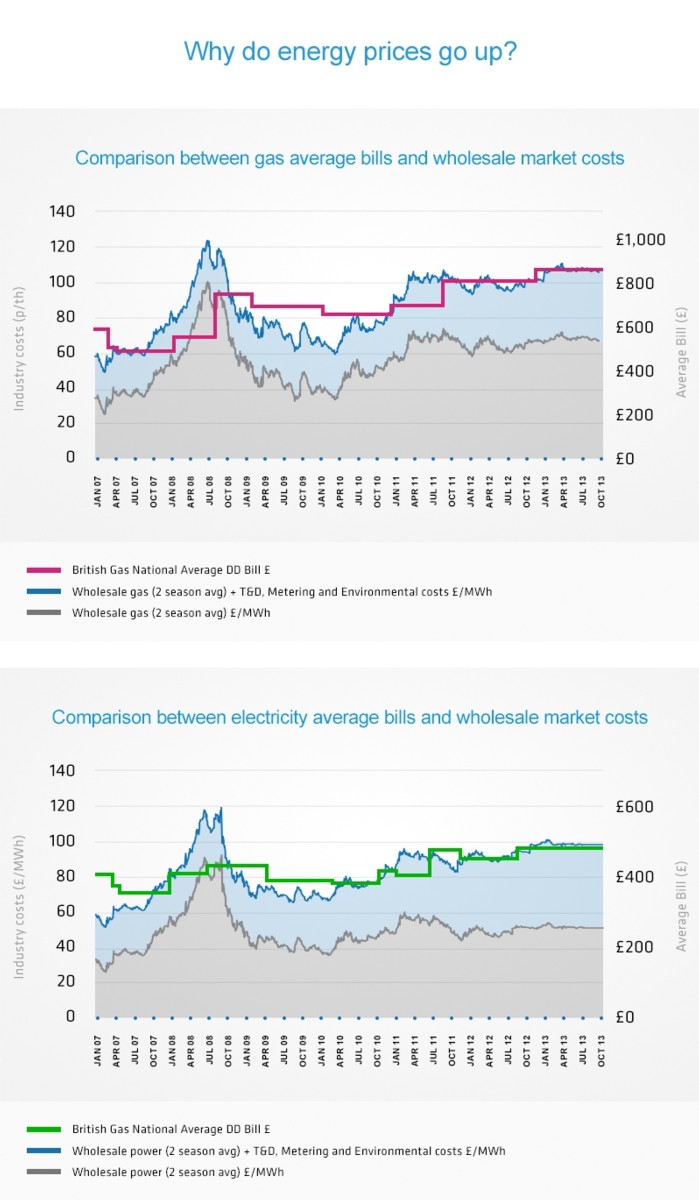

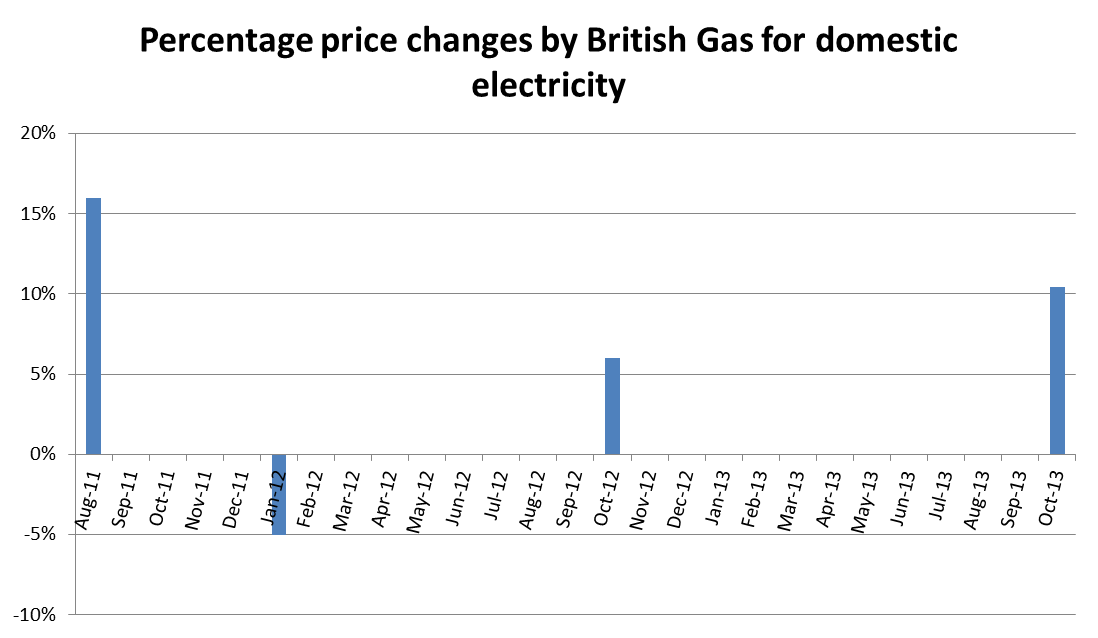

13) They also often don’t save the householder money. As other people, such as Paul Dodgshun, will have said retail electricity is about three times the price of gas. Only heat pumps with a Seasonal Performance Factor of more than 3 will reduce household bills in a property previously heated by gas.

14) The actual Coefficient of Performance of even a well-installed modern air to water heat pump during times of very cold weather is often less than 2. This poor performance is mostly down to immutable laws of physics (please note the comments of Paul Dodgshun at http://www.carboncommentary.com/2013/03/25) and not even a strong government can do much about this. For every unit of electricity consumed when outside temperatures are lower than -5 degrees less than two units of heat are being generated. (Some people have found the number is often even lower than this. See an article on my web site at http://www.carboncommentary.com/2012/02/08/2268.) The strikingly poor performance of air-to-water heat pumps at times of cold weather is, of course, happening when overall heat demand is at its highest.

15) The impact of the installation of large numbers of heat pumps is therefore to significantly increase electricity use at times of peak demand. I million heat pumps, might add between 10 and 15 GW to the UK’s peak need, adding about a quarter to the level of electricity demand at around 5-5.30pm on the coldest weekdays in December and January.

16) This problem is not recognised by policy-makers who continue to use average Coefficient of Performance figures for heat pumps and do not acknowledge the striking fall off in efficiency at times when UK temperatures are well below zero. Neither do they acknowledge the impact on household electricity bills of lower cold weather efficiency from air-to-water heat pumps. A kilowatt hour of heat will cost as much as eight or nine pence. This twice what customers on the gas grid would pay, 50% more than biomass heating and very roughly the same as oil central heating at current prices. In fact, ASHPs will sometimes cost more than off-peak dual rate electricity. So for almost all households the installation of an air-to-water heat pump makes no financial sense even if they carefully install a modern and well-engineered version.

17) What about the UK as a whole? ASHPs will increase peak electricity demand, as well as causing growth, albeit at a slower rate, in average power use. This is an absolutely critical point and should be fully explored.

18) Increasing peak electricity usage is bad for a number of reasons. The most important of these is that it requires a society such as the UK to construct and maintain a larger fleet of standby electricity generating plants (‘peakers’), probably powered by fossil fuels. As DECC is currently noticing, this is expensive. A gigawatt of standby gas fired capacity is going to cost perhaps £60m a year in capacity payments and, at the margin, will be used a few hours a year. (We don’t have the precise figures for the capacity payments yet).

19) In paragraph 15, I noted that I million ASHPs might add 10 to 15 GW to peak demand in the UK. Let’s assume the actual figure is 12 GW. The capacity payments to cope with the increase in demand from these 1 million heat pumps are therefore likely to be around £720m a year.

20) Arithmetic suggests that a single heat pump therefore imposes an incremental cost of £720 a year on UK energy users. (It could turn out to be £500 or it could actually be £1,000. The point is that this deadweight social cost is very significant but is never included in the costing of financial support for this technology).

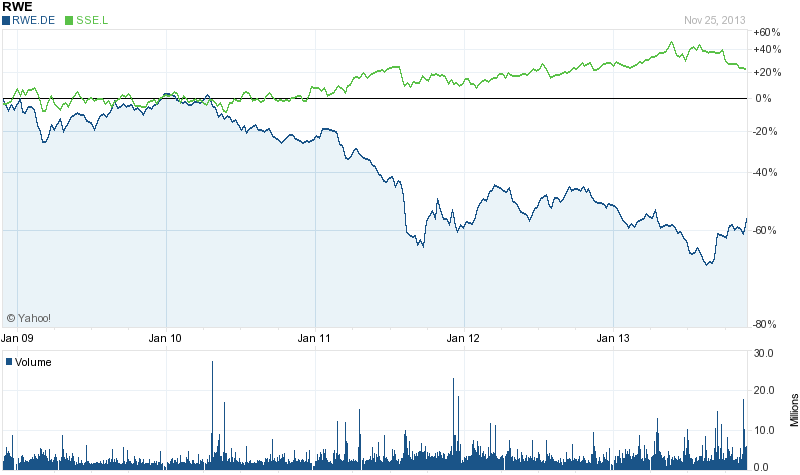

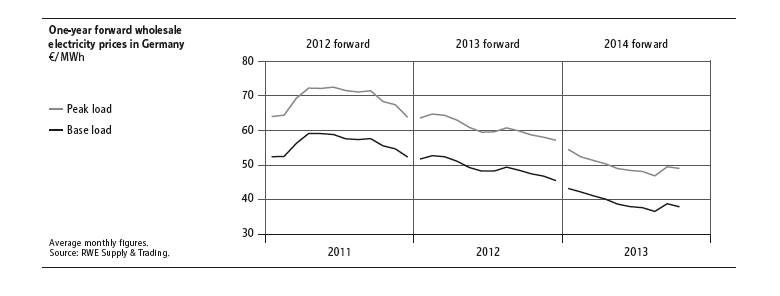

21) To put this even more clearly, the owner of this incremental heat pump might see an electricity cost of around £900 a year for his or her heating bill, less the savings in the fuels replaced by the ASHP, such as oil, as suggested in paragraph 16. The houseowner may or may not see an increase in fuel bills. But the marginal cost to society as a whole will be about £720, just from capacity payments, for a single heat pump. If the average heat pump uses about 7,000 kWh of electricity a year it is therefore receiving an entirely invisible subsidy of about 10p a kilowatt hour, more than solar PV or onshore wind. It will not be long before the opponents of decarbonisation fix their eyes on this unnecessary cost.

What should the UK do instead?

22) Presently, gas boilers provide most of our domestic heat. They are highly efficient, very safe, and reasonably reliable if maintained properly. Cheap to install and simpler to operate than ASHPs, gas boilers are wonderful things. As a society, we have an infrastructure of gas pipes, gas storage plants and firms that install and service domestic gas boilers. All other things being equal, we should want to maintain this existing resource and definitely not switch to a new technology such as heat pumps with clear problems of reliability and complexity for homeowners.

23) As a society we decided to move away from gas for heating because for two reasons: First, gas is subject to severe price swings and the long run trend in gas prices is likely to be upward. (The UK’s gas prices are set by the world market. Whether or not the UK successfully develops a gas fracking industry will not significantly affect the price we pay either way). Second, burning gas in large quantities is incompatible with the UK’s climate change policies.

24) How can we reconcile the need to reduce carbon emissions and still stick with a domestic heating infrastructure dominated by gas? There is only one way forward: a drive to develop renewable gas.

25) Renewable gas from anaerobic digestion will never be able to generate more than 10 per cent of our gas needs. In fact I doubt it will ever rise to more than five per cent.

26) A much more interesting opportunity, which I hope the Committee will explore with an open mind, is to convert surplus electricity into gas, and pump it into the existing gas network and storage facilities, for use when heating demand is high. In countries exploring this option around the world, such as Germany, Denmark and parts of Australia, the expectation is that ‘power to gas’ will achieve four things

- A reduction of peak electricity need from what would otherwise pertain.

- A reduction in the amount of electricity storage needed in the era of high renewables penetration

- Cheap and very low carbon gas.

- More stable electricity prices

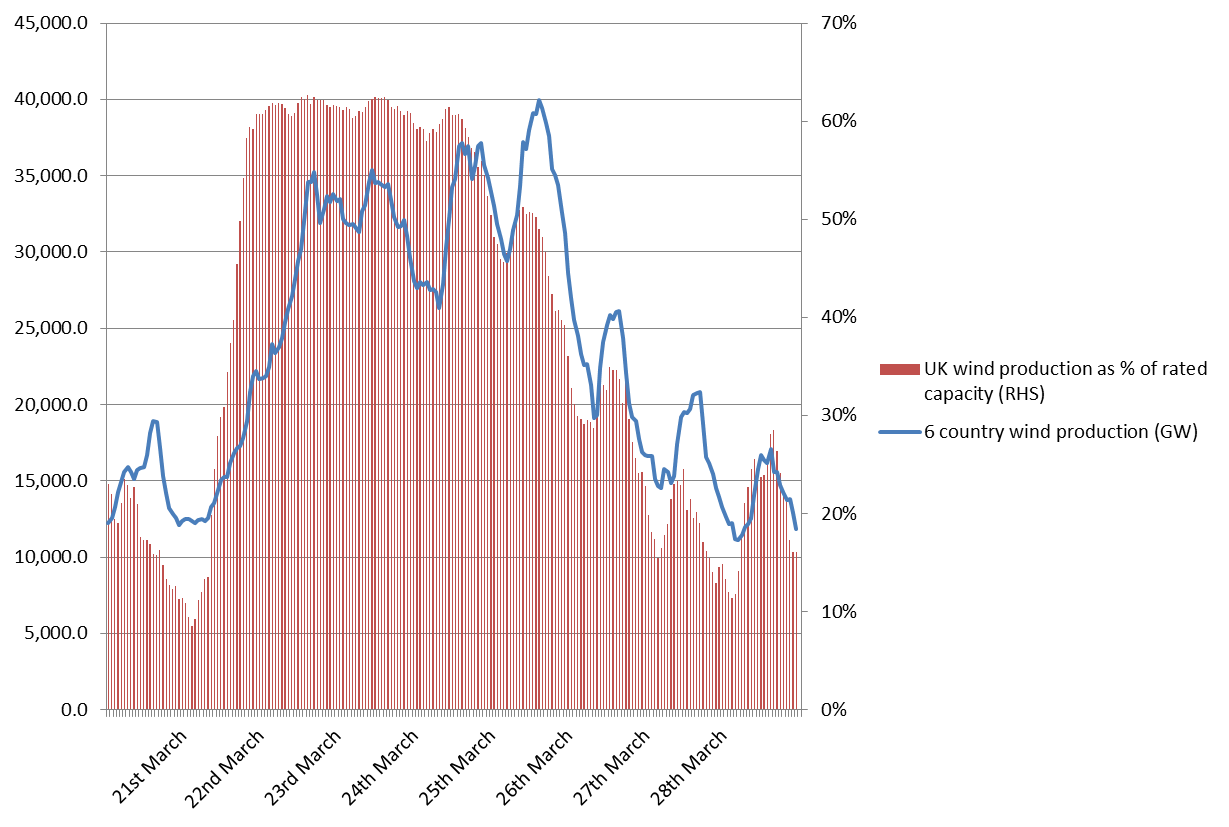

27) How does ‘power to gas’ work? At times of surplus electricity, such as when the wind is blowing strongly or the sun is shining brightly, the grid has too much power. If the UK meets DECC’s projections for wind, biomass power and nuclear, there will be many days each year, usually in the warmer half of the year, when far too much electricity is produced. I’m afraid DECC believes that improving interconnection with Europe will alleviate this problem. This is an error. If the wind is blowing here, it is blowing (perhaps not as strongly) across all of northern Europe. The surplus electricity arising from a gale cannot be stored in any significant amounts. Despite what is sometimes optimistically said, no conventional storage technology can hope to hold more than a few hours excess power. We might, just might, have the capacity to store two hours electricity use by 2020. We need to be able to store two months’ worth if we are to take surplus power in summer and use it to meet winter heat demand.

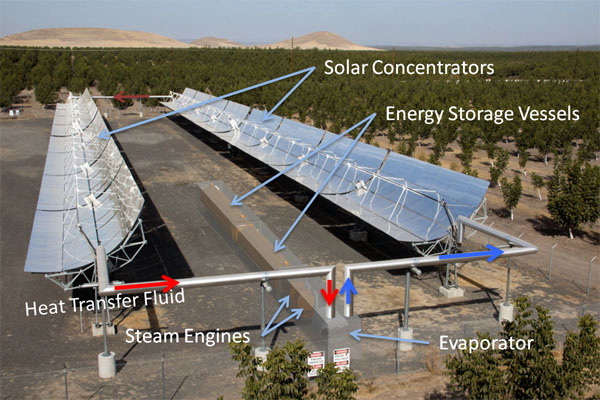

28) Cold and dark winter early evenings are when electricity demand peaks. But as my first paragraphs pointed out, the peak in overall energy use comes from the huge expansion in heating demand at these times. The UK and other countries therefore face the urgent need to store summer surplus electricity as gas. The idea is simple: turn spare power into hydrogen through electrolysis (cheap, reliable, scalable, modular) and then react hydrogen with CO2, to create methane (natural gas) either through the well-known Sabatier reaction or through transformation with micro-organisms, such as advocated by the innovator Electrochaea. Both processes turn 1 MWh of electricity into about 620 kWh of gas in terms of calorific value.

29) The gas network has a storage capacity several orders of magnitude greater than any conceivable alternative. In Germany, for example, the network of pipes, pumping stations and underground storage caverns can hold 200 days use. Contrast that please with the UK’s pumped storage capacity today of about one hundredth of one day’s electricity demand.

30) When energy industry executives are first exposed to the idea of storing electricity as natural gas, they are incredulous. Their training and industrial experience tells them their business is to turn cheap gas into expensive electricity. Why, they smile, should we take wholesale electricity that sells for £50 a MWh and turn it into natural gas that commands perhaps a third of this amount after calculating conversion losses?

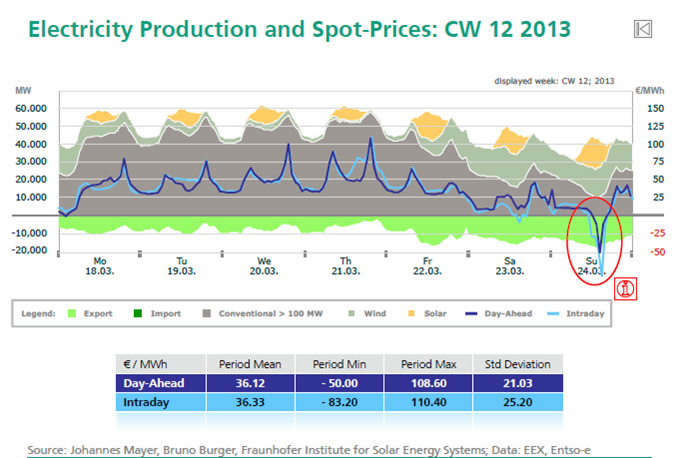

31) The power markets are changing. The growth of UK renewables (with zero marginal cost of operation and intense peaking of supply) will alter the pricing of electricity dramatically. Germany shows us what is going to happen soon. During June 2013, the average day-ahead power price was about €28.3 per MWh (just over £24), far lower than the UK. In fact, the average German power price was no higher than the price of gas per unit of energy. But, even more importantly, the variability of wholesale prices was huge. The Standard Deviation was over €14.6. What does this mean? It means that across the month electricity was worth less than €13.7 (about £11.76) a MWh almost 16% of the time. This is far lower than the price of gas, even at its summer UK minimum.

32) Some of the time in June, German electricity changed hands at sharply negative prices as high solar and wind power output swamped the country’s capacity to export electricity. In some senses, periods of very low electricity prices are good. Consumers might benefit. In other senses, here as in Germany, it is an utter disaster as the negative price signal warns utilities of the risk of investing in expensive new generating plants. We’re certainly seeing this in the UK already.

33) The crucial points are these: if ‘power to gas’ plants can siphon off surplus electricity from solar and wind, they will a) produce low carbon methane for the natural gas network and b) stabilise increasingly chaotic power markets. Moreover, we will have the capacity to meet high levels of heat demand in winter using surplus power. And, also importantly, we will use – and not waste – the output from the huge number of offshore wind turbines the UK will install in the next two decades. ‘Power to gas’ improves the value of renewable sources of electricity by, in effect, making them dispatchable power. Lastly, we will avoid having to invest in huge amounts of standby electricity generation capacity that sits waiting for the few hours a year of peak demand.

34) The Committee will be all too aware of how soon the UK will start getting significant and unpredictable short term and seasonal surpluses of electricity. The central forecast of the Committee on Climate Change is for 50 Gigawatts of wind power by 2030. Nightime summer demand is now typically below 25 Gigawatts and this number will probably fall as heavy industry declines further and home energy efficiency improves. So by 2030 an Atlantic storm in June will see power surpluses for hours and perhaps days just from wind power alone. Even in December, night power demand is less than the maximum wind power output from 50 GW of wind. The more variable renewables we install, the more we need ‘power to gas’.

Conclusion

The proposal I am advocating in this paper is to convert surplus electricity to convert into gas for use in heating homes in the winder. This will a) provide a market for electricity when supply exceeds demand and b) reduce the need for peaking gas plant when demand exceeds low carbon electricity supply. I urge the Committee to investigate this opportunity further because I believe it is the only conceivable means of providing low carbon heat to UK homes and stabilising the UK electricity grid without enormous capacity payments. By contrast, air source heat pumps add to the UK's problems, despite their extravagant UK policy support.

If you are interested in the prospects for Power to Gas, you might be interested in reading about Electrochaea's Danish prototype plant at www.electrochaea.com/uploads/1/1/4/0/11408432/press_release_20130813_-_electrochaea_commissions_foulum_project.pdf

and E.ON's 2MW Falkenhagen plant at http://www.eon.com/content/dam/eon-com/%C3%9Cber%20uns/Innovation/Energy%20Storage__PowertoGas.pdf. The E.ON plant was formally opened on 28.08.2013)

Chris Goodall, 25th August 2013